So the iPhone 3G S is lust-worthy, if for no other reason than the 3MP autofocus camera and the speed increase. There’s plenty of news about how AT&T is lagging – no MMS (coming), no tethering (maybe coming), giving smaller discounts to iPhone 3G customers than to new customers.

I’m not eligible for the $299 price because I’ve given Apple too much business, thus AT&T has had to subsidize me twice (read: I bought an original iPhone and a year later bought an iPhone 3G). So I get the option to wait until October to get the $299 price, or pay $499 now. I’ll wait, thanks. Maybe for whatever Apple announces next summer.

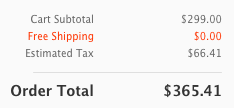

But Heidi never upgraded to the iPhone 3G, so she’s eligible for the $299 price. Great, let’s put that puppy in the cart. Whoa, look at the tax!

Yep, the tax is calculated as 9.5% (welcome to California) on the full $699 retail price of the phone. AT&T doesn’t subsidize that, and I couldn’t find it disclosed anywhere. I asked the Apple Store live chat — they were useless (told me the tax was on the $499 price) until I (duh) backed into the number on my own.

So, Apple’s ads should say the 32GB iPhone costs $699, minus an “instant rebate” that depends on how much AT&T has already subsidized you. But giving the real price wouldn’t sound as lust-worthy, would it?

Update July 18:At the online Apple Store, there’s small print at the bottom of the buy iPhone page that says

In CA, MA, and RI, sales tax is collected on the unbundled price of iPhone.

The CA regulation that requires Apple to collect this tax is documented at http://www.boe.ca.gov/pdf/pub120.pdf. What Apple doing isn’t illegal — just a bit misleading.